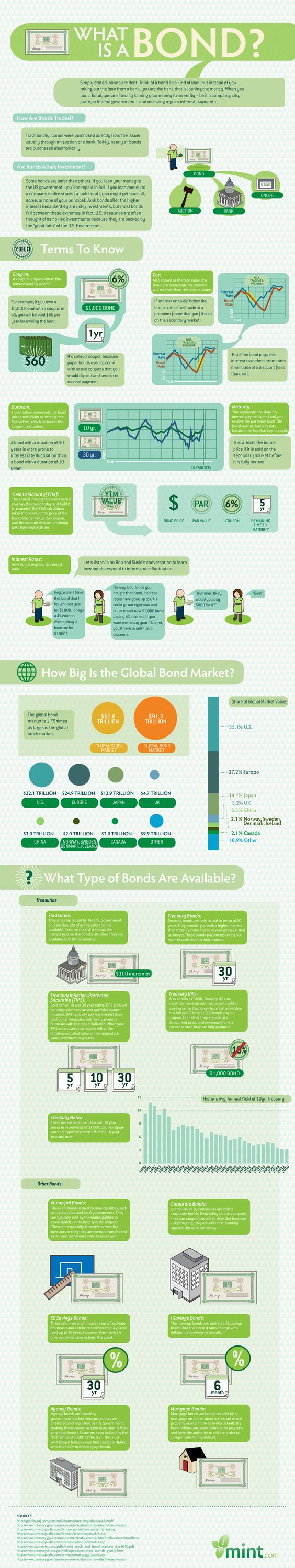

Earlier in the blog, I talked about diversification according to risk. There are various ways that you can stack your profile to offset riskier investments, one of those ways is through investing in bonds. If you are like me, you prefer to have a more holistic background of information when researching a topic. That is why I love this info-graphic made by Mint, telling you what a bond is, how it works, if it is a safe investment, terms to know, how big the market is etc.

This may not be information that is pivotal to your investing strategy, however, this visual representation was helpful for me when I was strategizing how to invest in bonds. When I was starting out, I didn’t know what the difference between a bond and a CD was. A CD is a timed deposit, where you don’t withdraw any funds until the maturity date. CDs are traditionally opened with banks and other financial institutions. Bonds on the other hand, are a debt security. Bonds loan money to an institution which borrows for a defined period of time at a fixed rate. CDs are a less risky investment than stocks, because they are insured by the Federal Deposit Insurance Corporation (FDIC), if the bank is an FDIC member.

Another point that is there are also bonds available across markets, countries, and currencies. As listed in the infographic, the global bond market is a $91.3 Trillion-dollar industry, compared to a $51.8 Trillion-dollar stock market industry. We are living in a global economy where you have opportunities to invest in countries other than your own. As listed, the United States has the largest market, followed by Europe, Japan, the UK, and China. I was surprised to discover that China only makes up 3.3% of the global bond market.

Bonds are also typically less risky than stocks; however, the type of investment that works best for you all depends on your financial goals and risk you are wanting to take. I really like the type of bonds available section of this infographic. Listed, are treasuries, treasury bonds, treasury inflation-protected securities, bills, notes, and other types of bonds. Additionally, it lists the duration of the bond if available and other facts. This really helps you to learn about the different options available for any type of investor.

Sources: https://www.ally.com/cds/cds-or-bonds-whats-the-difference/